When traveling abroad, you can easily find yourself in a situation where you need to receive money from someone abroad.

Whether it is for an unexpected emergency, you find yourself short of money, or someone specifically asks you to take something home for them, you need to be prepared and know how you will receive these funds exactly.

Since there are plenty of options, and each comes with its cons, deciding which money receiving method to use can be quite confusing. To make this process less stressful, read through this article to find out everything about receiving funds if you’re in another country and how to receive them easily.

What You Need to Know

In some cases, the sender may be charged transaction, cancellation, or amendment fees when making international money transfers. As a receiver, you may also be subject to receiving fees, which would be withdrawn from the transferred amount. Sometimes, the funds may also be re-routed from the sender’s bank to other intermediary banks; this is because a global network of banks handles all international payments, called the SWIFT system. All of these different banks can charge their own fees that will be paid by the sender or withdrawn from the amount being received.

When receiving money internationally, you also need to account for exchange rates, which will affect the final amount of money that you receive. If the sender doesn’t apply the current exchange rate upon the transaction, you may end up receiving less money than expected. Even if you receive a large amount of money, small differences in exchange rates can greatly affect the final amount of money. Ask the sender to keep the exchange rates in mind when transferring to avoid this or use RemitFinder, to look for an international money transfer service.

International Money Transfer Service

As previously recommended, you can seek an international money service for an easy way to receive money transfers from abroad. International money transfer services usually provide competitive exchange rates and lower transaction fees. The sender must set up an online account with the international money transfer service and use the exchange rate of the currency you want. You also need to provide the sender with your bank details to transfer the funds into your bank account.

Money Lenders

If you are in a situation where asking someone to transfer money to you is not a viable option, you can resort to a licensed money lender. In many countries like Singapore, for instance, this method is legal and licensed. You’ll find that a top money lender in Singapore typically offers flexible repayment options and low-interest rates. Considering a licensed money lender may be your easiest option.

International Money Order

The sender can contact an international financial institution and request an international bank draft in the selected currency. The sender uses funds from their personal account to cover the amount of the check you will receive. After receiving the check, you can deposit it into your bank account or cash it out at a local bank. However, this option is not very practical if the funds are urgent because this process may take several weeks.

Bank-to-Bank Transfers

Bank transfers are also a way to receive money abroad. It is a simple transfer of money from one account to another and can be done when the sender transfers money from their account. This process can be completed online or through mobile banking.

What you need to do is provide the sender with your SWIFT or bank code, account number, residence address, your bank’s name, and of course, your full name. If you are unsure about any of these details, you can retrieve this information from your bank. However, keep in mind that banks usually apply their foreign exchange fee on top of the margin that is already applied to the exchange rate, making this typical method very costly.

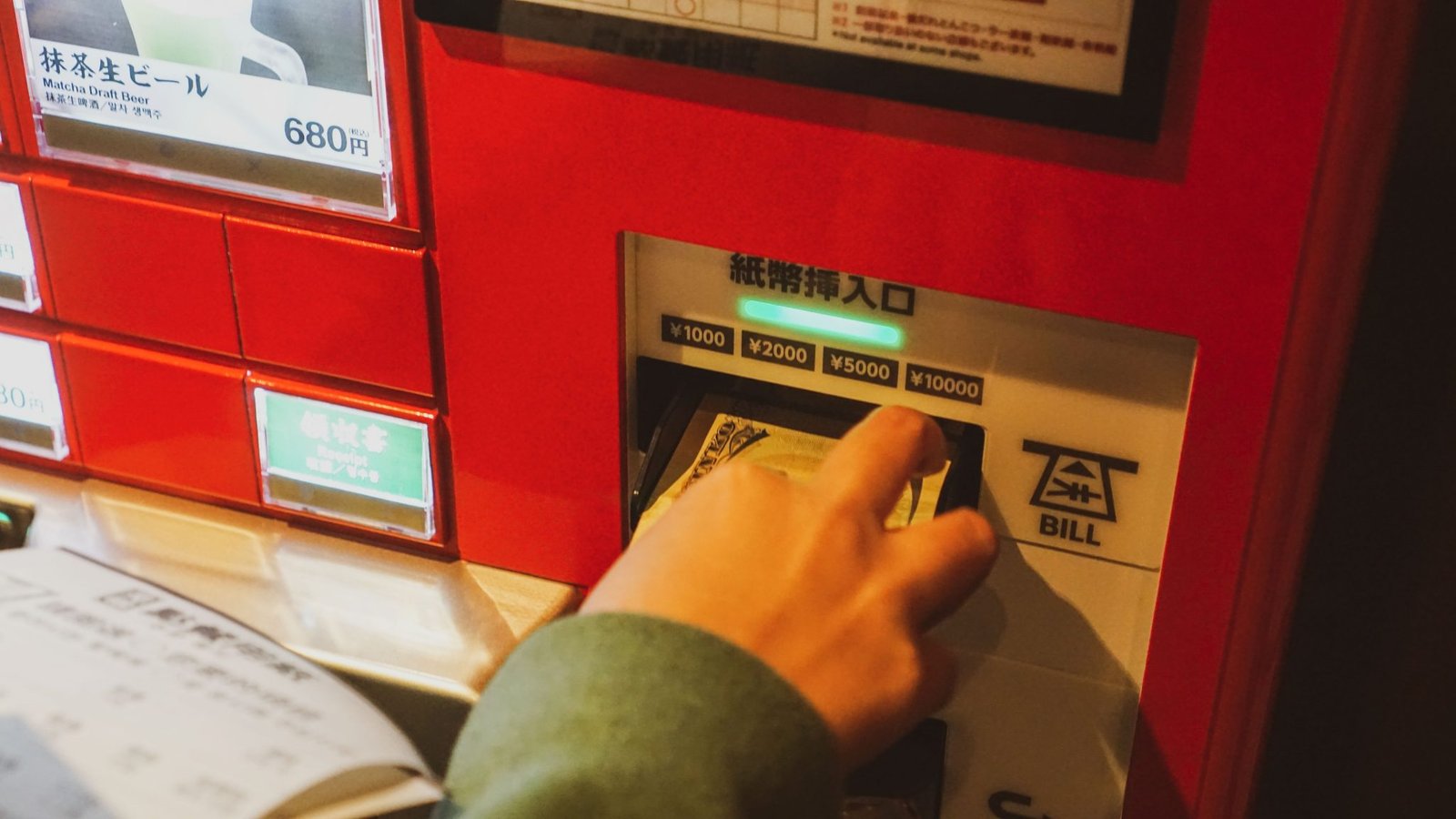

Cash Pick Up

Although collecting an international payment as cash is a process that can typically be done through your bank, you can also arrange to complete this process through a third party store or merchant. To collect your cash from the desired or arranged spot, you need a legitimate form of identification and the transaction reference number. This method is usually easier than others because you won’t have to set up an account with your bank, do it through a third party, or set up an account with an international money transfer service.

You might likely need someone to transfer your money if you are traveling abroad. Many options will allow you to receive funds internationally. However, you must be very careful because although some of these options are typically easier than others, they may be very costly or very time-consuming. We gathered a few of these options to help you weigh them out.