Five Reasons Why You’re Paying Too Much For Your Car Insurance And What To Do About It

Car insurance costs can vary a lot depending on several factors.

By understanding what those factors are, you can learn what to do about them in order to lower the cost of your auto insurance.

So, check out the following five reasons why you could be paying too much.

You’re Not Comparing Different Car Insurance Quotes Online

One of the main reasons why people don’t lower the costs of their car insurance is because they don’t take the time to compare quotes from multiple insurers. In this digital day and age, it really is simple to compare quotes online to get the best deal.

Get started at CheapInsurance.com. You can access hundreds of the best car insurance companies to find the cheapest quotes.

You’re Not Maintaining a Clean Driving Record

One key factor that affects the cost of your car insurance is your driving record. Insurers will look at your driving record to find out things like the traffic tickets you have received or the accidents you have been involved with.

If you have a history of poor road behavior, your car insurance rate is sure to be higher. On the other hand, when you maintain a clean driving record, you can enjoy lower insurance premiums.

So, if you’re paying too much for your auto insurance because of your driving record, make sure you drive carefully from now on.

You could instantly lower your car insurance cost if you agree to modern telematics technology, which involves fitting a device to your car so that your insurer can monitor your speed, acceleration, and other factors. That will allow you to practice safe driving and be rewarded with a lower auto insurance rate.

You’re Not Taking Steps to Lower Your Credit Score

Many car insurance companies use your credit score to discern how responsible you are. If you have a low credit score, your insurance costs could be higher. Of course, the opposite is also true.

So, if you want to lower the cost of your car insurance, take steps to lower your credit score, such as paying bills on time and not getting into debt.

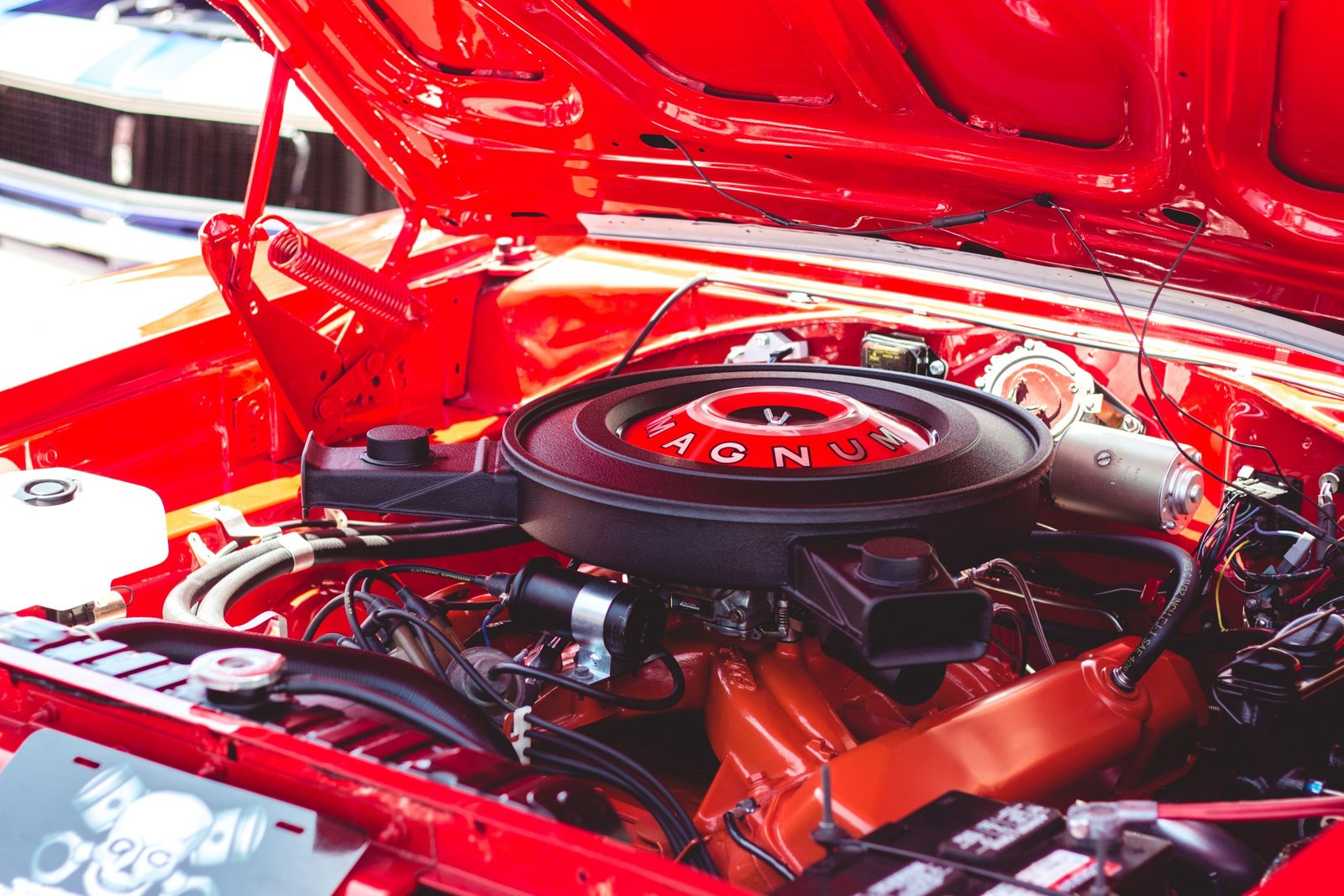

You’re Driving an Expensive Car

The type of car you drive can affect the cost of your auto insurance. For example, if you drive an expensive sports car, it will cost more to repair or replace should you have an accident, which means the insurance rates for expensive cars are significantly higher than for more standard cars, such as a sedan. Your car insurance rate can also be determined based on your model’s specific safety record and equipment. If your car is known to increase the chance of inflicting damage during a road accident, your car insurance company could charge you more for liability insurance.

Carefully consider the car you drive if you want to lower the cost of your auto insurance. It could be worth changing your car if you’re able to make significant insurance savings.

You Live in an Area Where Car Insurance Rates Are High

Where you live can make a difference to the cost of your car insurance. In the United States, car insurance premiums greatly vary from one state to another. That is due to several reasons, but the crime rate plays a key role.

If you live somewhere where there is a high crime rate, your insurance company will usually charge a higher rate because you’re more likely to file a claim for vandalism or theft at some point.

While you probably won’t want to move states just so you can save on your car insurance, if you’re considering moving and have several options, you might want to take things like car insurance costs into account.